On February 10, 1979, two significant Ordinances were enacted in Pakistan to incorporate Islamic punishments for offences such as theft and adultery. Additionally, two more Ordinances were introduced to specify the method of administering whipping as a punishment and to amend the second schedule of the Code of Criminal Procedure, 1898, facilitating the enforcement of whipping and empowering authorities to make arrests in certain cases.

Hudood Ordinances

Under Ordinance VI of 1979, courts are empowered to impose severe punishments for theft, reflecting traditional Islamic penalties. A first-time offender may face amputation of the right hand from the wrist, a second-time offender may have their left foot amputated up to the ankle, and for third-time and subsequent offences, life imprisonment is prescribed. Similarly, Ordinance VII of 1979 empowers courts to punish adultery with stoning to death.

The Prohibition (Enforcement of Hadd) (Amendment) President’s Order No. 12 of 1983 imposes penalties for manufacturing and trafficking dangerous drugs such as opium, heroin, and cocaine. Convicted individuals face imprisonment for at least two years, up to 30 stripes of whipping, and a fine.

Evidentiary Requirements and Safeguards

Punishments under Ordinances VI and VII are not routinely awarded but require stringent proof standards. For theft, the testimony of two credible witnesses of exemplary character is necessary. For adultery, four witnesses of similar standing must testify. These stringent evidentiary requirements serve as safeguards against wrongful convictions.

Furthermore, both Ordinances include provisions for lesser punishments, drawing from the Penal Code, supplemented by the punishment of whipping. Medical examination by officers before and during the punishment is mandated, ensuring compliance with health standards.

Prohibition on Alcohol

The Government of Pakistan, under Islamic laws, has also imposed strict prohibition on alcohol. The prohibition laws, supplemented by provincial ordinances, stipulate that no Muslim, whether a citizen of Pakistan or from another country, is allowed to consume, sell, manufacture, or deal in alcoholic beverages. Non-Muslims are allowed to consume alcohol only within their homes. Violations of these regulations attract severe penalties, including whipping.

Abolition and Amendments

The Abolition of the Punishment of Whipping Act, 1996, abolished whipping under laws other than hadd. Additionally, the Anti-terrorism Act, 1997, was enacted to prevent terrorism, sectarian violence, and ensure speedy trials of heinous offences. This Act also prescribes a two-year sentence for officers conducting defective investigations.

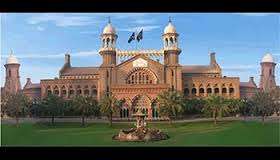

Federal Shariat Court (FSC)

The Constitution Amendment Order, 1980, established the Federal Shariat Court (FSC), replacing Shariat Benches of High Courts. Comprising five members, including a Chairman with the rank of a Supreme Court Judge, the FSC is empowered to review laws for conformity with Islamic injunctions, except for the Constitution, Muslim personal law, procedural laws, fiscal laws, and laws related to taxes, fees, banking, or insurance. The FSC’s decisions can render laws ineffective if found repugnant to Islamic teachings. Notably, in November 1991, the FSC invalidated provisions related to interest in 22 laws, requiring amendments by June 30, 1992. However, this decision was later suspended for further analysis of interest in Islam.

Islamic Banking and Finance

The Banking Companies (Third Amendment) Ordinance, 1980, allowed banks to accept deposits on a profit-and-loss sharing basis, aligning with Islamic principles. The State Bank of Pakistan’s Circular of June 20, 1984, eliminated interest from the banking system, replacing it with profit and loss sharing, mark-up pricing, leasing, and equity participation. These measures were implemented through the Banking and Financial Services (Amendment of Laws) Ordinance, 1984, and the Banking Tribunals Ordinance, 1984, which facilitated the recovery of finance under these new systems.

Zakat and Ushr

The Zakat and Ushr Ordinance, 1980, mandates the collection of Zakat (a 2.5% tax on assets) and Ushr (a 5% tax on agricultural produce) from Muslim citizens and companies majority-owned by Muslims. Zakat is collected at the source for certain assets, with self-assessment for others. Zakat funds are utilised for aiding the needy, orphans, widows, and for public hospitals and educational institutions. Amendments in 1980 and 1984 exempt assets acquired or maintained in foreign currency from compulsory Zakat deductions.

Modaraba Companies

The Modaraba Companies and Modaraba (Floatation and Control) Ordinance, 1980, regulates the establishment and operation of Modaraba companies, which engage in business ventures based on profit and loss sharing. Public participation in Modarabas is facilitated through the purchase of Modaraba certificates, with the Modaraba company subscribing to at least 10% of the total amount. The Registrar oversees the administration, holding inquiries, and appointing administrators when necessary.

Law of Evidence

The Qanun-e-Shahadat Order, 1984, replaced the 1972 Evidence Act, aligning evidence law with Islamic injunctions. Courts must determine witness competence based on Islamic qualifications, though they may accept available witnesses if qualified ones are not forthcoming. Financial or future obligations instruments must be attested by two men or one man and two women, reflecting Islamic legal standards.

In conclusion, the integration of Islamic laws within the Pakistani legal system demonstrates the country’s commitment to harmonizing religious principles with modern legislative frameworks. This dynamic interplay continues to evolve, reflecting ongoing debates and reforms aimed at achieving a balance between tradition and contemporary legal requirements.

Recent Developments in Islamic Laws in Pakistan

The legal landscape in Pakistan continues to evolve with the integration of Islamic principles. Recent developments reflect ongoing efforts to harmonize traditional Islamic laws with contemporary legal frameworks, addressing modern socio-economic challenges while adhering to religious doctrines.

Islamic Family Law Reforms

In recent years, significant reforms have been made to family laws, focusing on protecting women’s rights and ensuring justice in domestic matters. The Enforcement of Women’s Property Rights Act, 2020, is a notable development aimed at safeguarding women’s inheritance rights. This Act mandates the protection and retrieval of women’s property, aligning with the Islamic principles of inheritance and addressing the societal issue of women being deprived of their rightful share.

Additionally, the Punjab Protection of Women Against Violence Act, 2016, provides a comprehensive legal framework to protect women from various forms of violence, including domestic abuse. This law includes mechanisms such as protection orders, residence orders, and the establishment of women’s protection centers, ensuring that the Islamic principle of protecting the dignity and safety of women is upheld.

Economic Reforms and Islamic Banking

The Islamic banking sector in Pakistan has seen substantial growth and regulatory developments. The State Bank of Pakistan (SBP) has introduced several measures to promote Islamic banking, including the issuance of detailed criteria for the establishment of Islamic commercial banks and the expansion of existing banks into Islamic banking. In December 2021, the SBP unveiled a comprehensive five-year strategic plan to boost the Islamic banking sector, aiming to increase its market share to 35% of the total banking industry by 2025.

One of the key aspects of these reforms is the focus on Sharia-compliant financial products and services. The SBP has encouraged the development of innovative Islamic financial instruments, ensuring that banking operations adhere to the principles of profit and loss sharing, risk mitigation, and ethical investment. These initiatives aim to provide a robust alternative to conventional banking, fostering financial inclusion and stability.

Judicial Interpretations and Federal Shariat Court

The Federal Shariat Court (FSC) continues to play a pivotal role in interpreting and applying Islamic laws in Pakistan. In recent years, the FSC has adjudicated on several significant cases, reinforcing the application of Sharia principles in various legal matters. For instance, the FSC’s judgments on issues such as the legitimacy of interest-based banking, the legality of certain punishments under Hudood laws, and the conformity of various statutes with Islamic injunctions underscore its influence in shaping the legal landscape.

The FSC has also been active in addressing contemporary legal issues through Ijtihad (independent reasoning). This approach involves reinterpreting Islamic laws to suit modern contexts, ensuring that legal principles remain relevant and effective. The ongoing discourse on the need for Ijtihad reflects a progressive attitude towards integrating Islamic laws with contemporary legal and societal needs.

Hudood Laws and Human Rights Concerns

The application of Hudood laws, particularly concerning punishments for theft and adultery, remains a contentious issue. Human rights organizations and legal activists have raised concerns about the harshness of these punishments and their potential for misuse. Recent years have seen a renewed focus on ensuring that the implementation of Hudood laws aligns with international human rights standards.

In response to these concerns, there have been discussions about reforming the Hudood Ordinances to incorporate more humane and just procedures. These discussions emphasize the need for stringent evidentiary standards, judicial oversight, and the protection of individuals’ rights, reflecting a commitment to upholding justice within the framework of Islamic law.

Prohibition and Drug Control

The enforcement of prohibition and control of narcotics has also seen developments aimed at aligning with Islamic principles while addressing contemporary challenges. The Prohibition (Enforcement of Hadd) Order continues to be enforced strictly, with recent amendments focusing on enhancing the effectiveness of drug control measures. These amendments include stricter penalties for drug trafficking and manufacturing, reinforcing the state’s commitment to curbing drug abuse in line with Islamic teachings.

Conclusion

The recent developments in Islamic laws in Pakistan reflect a dynamic and evolving legal landscape. Efforts to integrate Islamic principles with modern legal frameworks demonstrate a commitment to upholding religious doctrines while addressing contemporary socio-economic challenges. Reforms in family laws, advancements in Islamic banking, proactive judicial interpretations, and stringent enforcement of Hudood and prohibition laws highlight the ongoing process of legal evolution in Pakistan. As the country continues to navigate this complex interplay, the balance between tradition and modernity remains a central theme in the development of its legal system.